International Institute for Middle East and Balkan Studies (IFIMES)[1] from Ljubljana, Slovenia, regularly analyses developments in the Middle East, Balkans and around the world. Dr Maria Smotrytska is research fellow at IFIMES/DeSSA, a senior research sinologist, specialized in the investment policy of China. In her comprehensive analysis entitled “IFIMES Analysis of China’s “Belt and Road” Initiative: Genesis and Development” she emphasizes the importance of the initiative and its contribution to the cohesion of the countries of the 3 main continents (Asia, Europe, Africa) and the disclosure of their economic potential.

● Dr Maria SMOTRYTSKA, Research Fellow at IFIMES/DeSSA

IFIMES Analysis of China’s “Belt and Road” Initiative: Genesis and Development

Understanding the foreign policy and geo-economic strategies of countries, especially in such a difficult time when national borders are closed and the “militarization” of cybersecurity (Hopkins, 2012), becomes an important, if not vital, task for each individual country in its attempts to take its rightful place in building a new world order and development economy.

In the XXI century, it was impossible not to notice the rapid economic growth of Asia, given that the growth rates of each of the national economies of the region exceed those of the Western countries (Mudbhary, 2006).

For a long time, Asian countries have taken the best of both worlds, building economic relations with China, and maintaining strong ties with the United States and other developed countries. Many Asian states for a long time have considered the United States and other developed countries as their main economic partners (US Dep. of State, 2020). But now they are increasingly taking advantage of the opportunities created by China’s rapid development.

Moving away from Asia, let’s have a quick look what is happening in East Europe, or Central Asia, or Latin America, or even Africa. Most of the countries in these regions are struggling (Nedopil, 2021) to take their place in “the geopolitical game” in pursuing of the benefits that Chinese investment can bring. But what is the main core and nature of Chinese Investments or Chinese geoeconomic “One Belt – One Road” project? The answer to this question is still unclear for most countries seeking to join (Jiang, 2021). To understand the Belt and Road Initiative, let us also take a brief look at 10 key basics of this initiative:

1. Why and when was the “Belt & Road Initiative” (BRI) created?

The Belt&Road Initiative (BRI) – is an umbrella initiative spanning a multitude of projects designed to promote the flow of goods, investment, and people. The new connections fostered by the BRI could reconfigure relationships, reroute economic activity, and shift power within and between states.

The Scope of the Initiative is very big which makes it difficult to clearly identify the main initiative’s goals. Thus, the best way to understand the purpose of the BRI – is to have a quick look on its development phases, each of which has its’ own aim and perspective:

1. Preparation period (1990s – 2000s)

After fruitful economic reforms in China (1970 – 1980s: during Deng Xiaopin’s reforms which pushed forward the transformation of China’s economy), in 1990s with the implementation of the concept of “one country, two systems” (biggest offshore zones Hong Kong and Macao returned under Chinese jurisdiction), the strengthening of Chinese geoeconomics became even bigger. As a result, during 1990s – 2000s financial crises China was the only country with steady currency (while regional stock markets collapsed), being able to provide to the region a platform for further economic boom (Sharma, 2002).

After 2008 global financial crisis it became clear that Chinese stock market is stable and can protect the development of regional economies (Wayne, 2009). China is starting to play a dominant role in the region (shift from “country with closed policy” into regional leader).

2. Conceptualization (2000 – 2012)

While 2000 – 2010 were accompanied by stable economic development (export oriented), the development gap between Chinese regions was getting bigger, weakening the status of a strong regional (and further global) economic power (OECD, 2010). Due to these Chinese administrations was trying to work on ways to develop less developed regions of the country – started to think on creating a regional integration mechanism within Asia, where China would play the key supplier role. Starting from 2004 China is getting more involved into supplying activities in the region, expanding the production and manufacturing, logistic facilities in low-developed areas of the country (2004 – opening of TRACECA transhipment line; 2008 construction of the transcontinental highway “West Europe – West China”; 2009 construction of gas transportation infrastructure between China and Iran; the early-mid-2010s large-scale transport and infrastructural projects in Central Asia etc.).

In 2011, when US Secretary of State H.Clinton proposed the development of a New Silk Road with Afghanistan as a centre (US Dep.of State, 2011), Chinese leadership decided to step in and to move from individual projects to a large-scale Eurasian strategy (Wade, 2016). This decision led to the creation of the BRI.

3. Implementation (2012 – 2017)

The main role of this stage was to build a stable basis of the Initiative, which could guarantee stable economic and infrastructural development. While promoting the BRI, Chinese were concentrating on diversification and facilitation of regions logistics system. Another important element of this stage was the creation of economically strong financial base of the initiative (2013 – launching of the BRI initiative (starting budget USD47 billion) (Page, 2014), October 2014 – creation of the Asian Infrastructure Investment Bank, Silk Road Fund etc.). and Initiative’s promotion (by May 2015 about 60 countries joined the AIIB (decision to join BRI project).

While putting enormous amount of investments into regions’ (mainly ASEAN, Russia, Central Asia) transportation systems, Beijing decided to spare a profit and export products outside using already existent transhipment routes (through TRACERA, Suez, Malacca straights etc.). As a result, in 2013-15, 348 international projects were started, while volume of USD 24.7 bln., in 2015 Chinese investment increased of 37% compared to 2014 and BRI became a “process – brand”, the period 2016 – 2017, total cost of infrastructural projects is estimated at USD 60 billion (Korolyov, 2019).

4. Expansion (2017 – ..)

In May 2017 radical changes in the dimension and nature of the initiative happened (Liangyu, 2017):

- initiative is based on transport corridors leading from China to Europe and Africa;

- Continuous flow of FDI to Central Asia, Transcaucasia, Eastern Europe, and the Middle East;

- launched the creation of new markets in countries along transit routes;

- radical changes in approach to FDI protection (Sejko, 2019).

These changes brought certain results into the development of BRI and China itself:

- in 2017 China put an additional USD15 billion to the Silk Road Fund (Jie, 2017).

- by the end of 2017 China’s trade turnover with partner countries increased annually by an average of 6% (WITS, 2017).

- 2019 – 2020 additional USD8.7 billion has been allocated for the needs of developing countries that were involved in the project (Lee, 2020).

- Estimated that USD 4 – 8 trillion will be invested in the BRI project by 2030 (BRI, 2020).

Thus, 2017 played a crucial role in turning the “regional integration initiative” into a new global level one.

To sum up, during Initiative transformation, its’ aims were gradually transforming as well:

- First Phase – to develop an approach for stable economic development of China;

- Second stage – to guarantee country’s positions as stable strong regional leader;

- Third stage – regional integration with expansion to neighbouring countries;

- Fourth stage – global expansion and occupation of the geo-economic space of minimum three continents.

Nevertheless, few general aims, which were there from the very first day of BRI’s implementation, can be identified:

- improving intergovernmental communication to better align high-level government policies like economic development strategies and plans for regional cooperation;

- strengthening the coordination of infrastructure plans to better connect hard infrastructure networks like transportation systems and power grids;

- encouraging the development of soft infrastructure such as the signing of trade deals, aligning of regulatory standards, and improving financial integration;

- bolstering people-to-people connections by cultivating student, expert, and cultural exchanges and tourism.

The end result of BRI should be the creation of a “Community of Common Destiny for Mankind” (人类命运共同体), defined as a new global system of alternative economic, political, and security “interdependencies” with China at the centre (zhongguo, 中国). For this reason, Chinese leaders describe BRI as a national strategy (zhanlüe, 战略), with economic, political, diplomatic, and military elements (综合国力), not a mere series of initiatives (People’s Daily, 2017).

Thus, BRI directly supports many elements of China’s national security strategy. At a macro level, it seeks to reshape the world economic order in ways that are conducive to China’s drive for Great Power status.

2. What does the creation of the BRI mean in terms of globalization?

While talking on the role of BRI in Globalization trends, its’ global and national scopes (impacts), should be empathized:

Contribution to the “world’s” Globalization:

- Transport and infrastructure development increases trade;

- increasing of connectivity;

- stabilization in monetary policy;

- stabilization of the level of security in the region;

- contribution to the cultural exchange.

Responding to global trends in globalization, based on the principle of mutual benefit and having a far-sighted perspective, BRI has several foreign policy strategic advantages that can contribute to the cohesion of the countries of the 3 main continents (Asia, Europe, Africa) and the disclosure of their economic potential.

Contribution to the “country’s” Globalization:

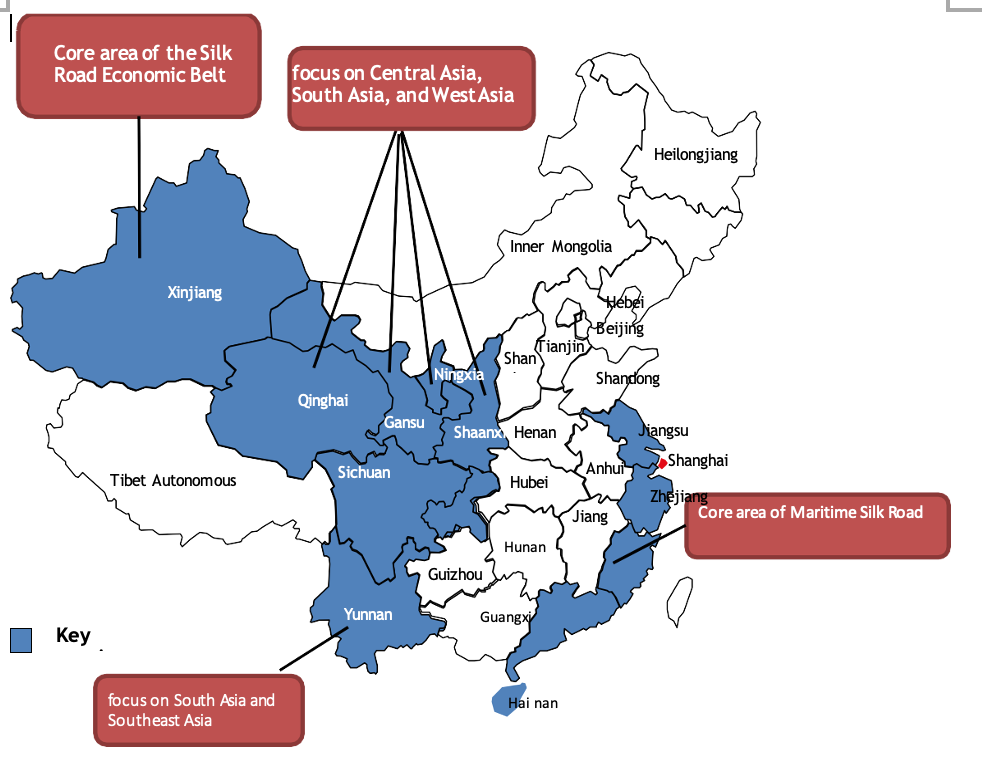

- BRI is intended to support the development and reform of all provinces and regions in China through involving them into global cooperation with the worlds regions;

- development and connectivity of China’s provinces and neighbouring countries;

- contributing to continued strong and sustainable growth in China while simultaneously benefiting from new commercial opportunities (See Attachment 1 below).

Attachment 1: Strategy on “Globalizing” of China

3. How does BRI relate to Xi Jinping`s government’s characteristics?

While thinking on BRI as a new trend in Chinese foreign policy, it is worth noting that it was the new way of thinking (and developing of the policy strategy) of The 5th generation of the P.R.C. administration (Administration of Xi Jinping). His predecessors were mainly concentrated on inner policy of China (namely strengthening of Chinese inner market, economy and reducing the “development gap” between the Chinese provinces and cities) and further strengthening of China as regional player (late years of the Administration of Deng Xiaoping). New Administration (Xi Jinping since 2012) decided to take Chinese foreigner policy to next level, announcing the conversation of the doctrine of the “Chinese Dream” (improving of well-being of Chinese people within China) into proper international status (first regional leader, then expansion of BRI into at least 3 continents).

What’s more, no Chinese leader has done more globe-trotting within such a short time (first term 2012 – 2016, second term 2016 – …). Since 2013, president Xi has logged 28 overseas trips that brought him to 56 countries across 5 continents, as well as the headquarters of major international and regional organizations.

As a result of BRI implementation, at least in terms of two of China’s policies – bringing in (qingjinlai) and going out (zouchuqu) – Xi’s first term (2012 – 2016) already marked a new era in Chinese foreign policy. But there was much more to the new era than the flurry of diplomatic visits. Xi introduced four new concepts into Chinese foreign policy: a new type of major country relations (P2P diplomacy, bilateral diplomacy approach, hub-regions integration (ASEAN, CEE etc.), major country diplomacy with Chinese characteristics (strategy of “blue water” (Koda, 2017), “diplomacy of straights” (Smotrytska, 2021) etc.), a global community of common destiny (strategy “Chinese dream” (BBC, 2013), and a new type of international relations).

Further, in 2017, while announcing the start of the expansion phase of BRI, Xi Jinping underlined again the importance of the balanced development of both China and BRI: “Chinese government seeks to

- “ensure and improve living standards through sustainable development”;

- it condones market “reform and opening” (gaige kaifang 改 革 开 放) and

- encourages Chinese enterprises to “go out” (zou chuqu 走出去) especially along the Silk Road Economic Belt and 21st Century Maritime Silk Road (and Polar Silk Road in near future) (Smotrytska, Jul.2021).

Thus, it can be seen, that in 2012 new Chinese Administration (Xi Jinping) noticed that China’s relatively slow growth rate since 2009 has required a rebalancing of its economy away from investment-led growth and towards a more consumption-driven economy (SRS, 2019). The realization of this fact forced new Administration to think on other possible ways to sustain and develop Chinese economy, which further turn into idea of the creation of new economic integration mechanism in the region (and further continent) – the Belt and Road Initiative. The further phrases of its development have been commonly used in China to indicate the importance of this recalibration.

Meanwhile, because of Xi Jinping new approach of the development of China, the country gained a profound impact on global economic development (which, is safe to say, China has never had before).

4. Why does China seem to be focusing on African countries?

China is both a long-established diplomatic partner and a new investor in Africa (Wade, 2019). Chinese interests on the continent encompass not only natural resources but also issues of trade, security, diplomacy, and soft power. China is a major aid donor, but the scope, scale, and mode of Chinese aid practices are poorly understood and often misquoted in the press (since they mainly analyse Sino – African relations only in terms of “what does China gain out of these relations”). It will be fair to emphasize, that few analyses have approached Sino – African relations as a vibrant, two-way dynamic in which both sides adjust to policy initiatives and popular perceptions emanating from the other.

While analysing the main reasons of the development of Sino – African ties (within BRI or not), it can be underlined that China has four overarching strategic interests in Africa:

1. China wants access to natural resources, particularly oil and gas. It is estimated that, by 2025, China will import more oil worldwide than the United States (Moran, 2010). To guarantee future supply, China is heavily investing in the oil sectors in countries such as Sudan, Angola, and Nigeria.

2. a huge market for Chinese exported goods, might facilitate China’s efforts to restructure its own economy away from labour-intensive industries, especially as labour costs in China increases.

3. China wants political legitimacy. The Chinese government believes that strengthening Sino – African relations helps raise China’s own international influence. Most African governments express support for Beijing’s “One China” policy (HK and Taiwan, Xinjiang Uygur Autonomous Region are fully Chinese territories), a prerequisite for attracting Chinese aid and investments.

4. China has sought a more constructive role as contributor to stability in the region, partly to mitigate security-related threats to China’s economic interests.

At the same time, African governments are counting on China to ensure political recognition and legitimacy and contribute to their economic development through aid, investment, infrastructure, and trade. To some degree, many African leaders hope that China will interact with them in ways that the United States and other Western governments do not – by engaging economically without condescendingly preaching about good governance, for example, or by investing in high-risk projects or in remote regions that are not appealing to Western governments or companies. Some Africans aspire to replicate China’s rapid economic development and believe that their nations can benefit from China’s recent experience in lifting itself out of poverty.

As one of the interviewers from African country noticed: “we (Africans) prefer to work with China, because if it (China) promises us (Africa) something (i.e. to build a highway or a plant, to invest in solar power facilities etc.) – it will do so, but if the same is promised by the US or Western Europe – we (Africans) will never see the results and furthermore will pay huge percentages and loans for nothing”. Afterall, it makes sense, as Central – East – European countries are mainly willing to cooperate with China because of the same reasons. Thus, it’s not surprisingly that not very high-developed (in terms of economy and infrastructure) countries are tempted to choose Chinese investments, over the Western countries or the WTO.

Thus, BRI, which mainly focuses on the development of large infrastructure projects, is a real hope for many African countries to fill their own infrastructure gap, with less cost and in a more efficient way (so far Chinese companies are top in logistics and infrastructure development and improvement) (Teixeira, 2019). As a result – as of September 2019, 40 of 55 African countries had signed some sort of memorandum of understanding or other agreement on the BRI (Development Reimagine, 2019).

Africa is also an important end user of China’s industrial overcapacities, particularly coal, cement, steel, glass, solar, shipbuilding, and aluminium, for use in BRI projects.

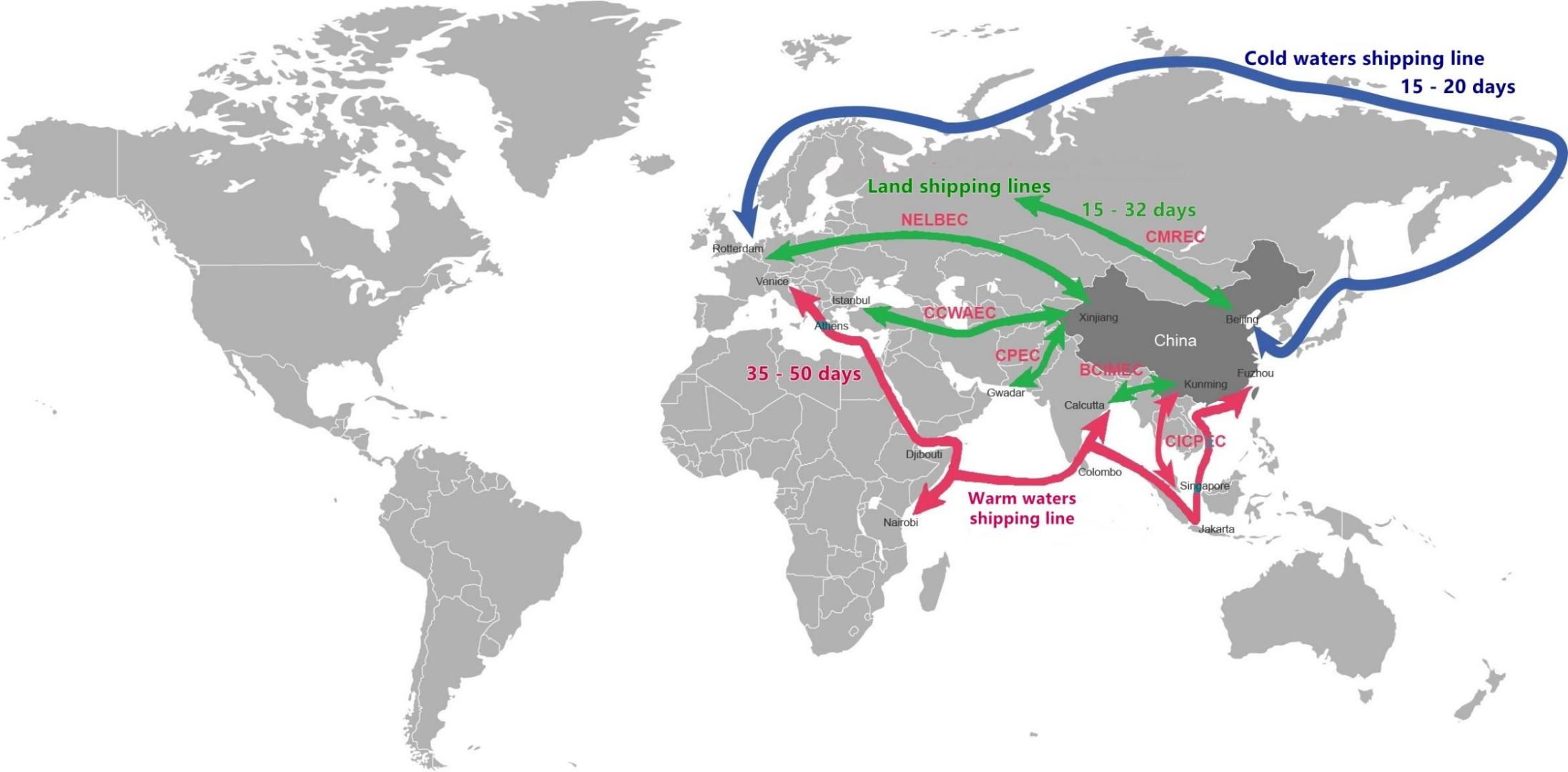

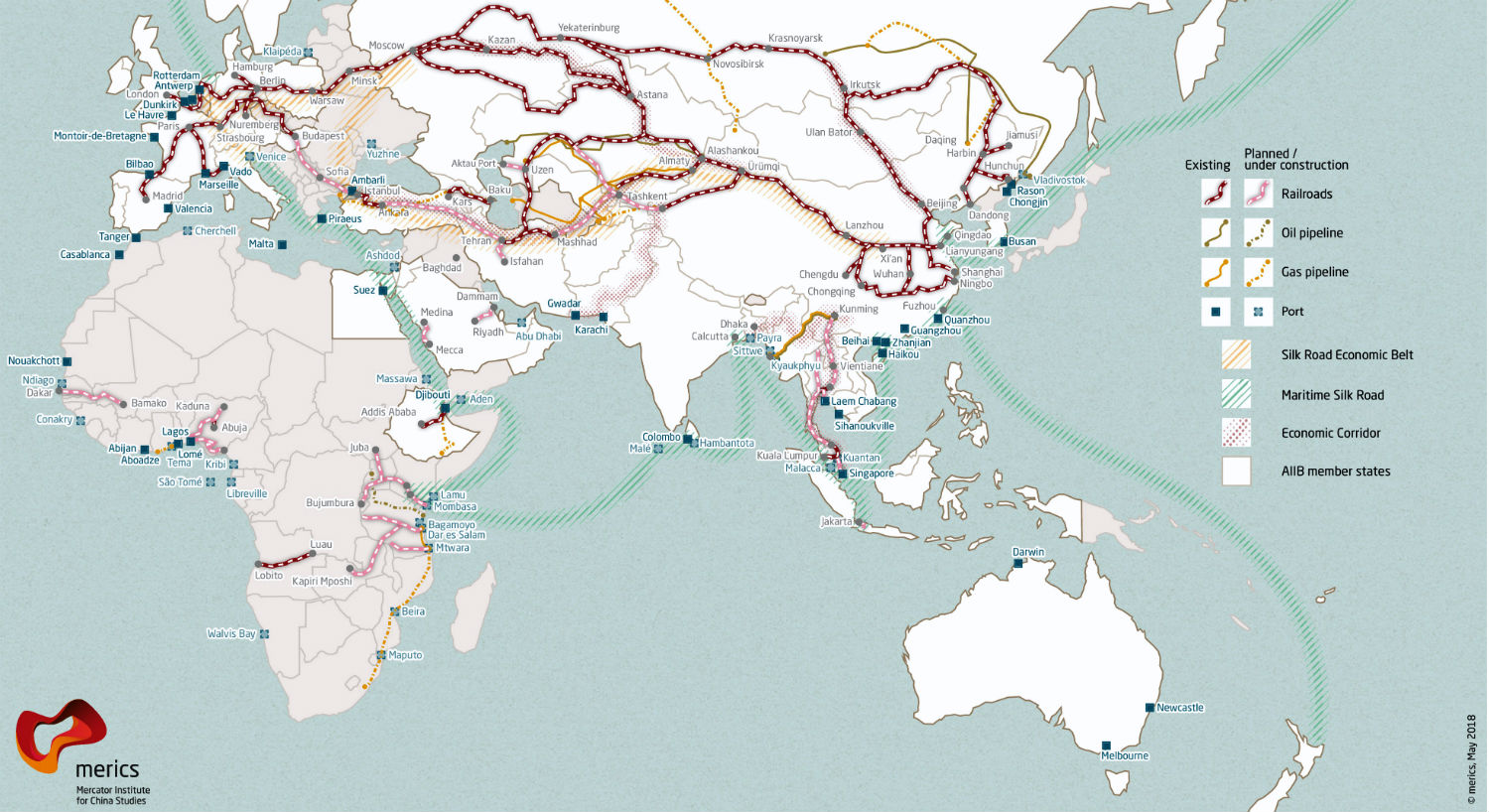

Also, it must be emphasized another, not necessarily official goal of BRI in Africa – geopolitics and geo-economics. Thus, with the help of African continent, BRI also increases China’s control of critical global supply chains and its ability to redirect the flow of international trade in the world’s sea. Central to these efforts are steps to open new sea lanes and expand China’s access to strategic ports around the world. Thus, while The Silk Road Economic Belt establishes 6 land corridors (or high-speed train and highways networks, oil, and gas pipelines), connecting China’s interior to Central Asia and Europe, The Maritime Silk Road (and possible Polar Silk Road) further establishes 3 “blue economic passages” knitted together through a chain of seaports from the South China Sea to Africa that also direct trade to and from China. (See Details in Attachment 2).

Attachment 2: Transhipment lines from Far East to Western Europe and Africa

African continent is of great importance to the implementation of China’s 13th Five Year Plan, a document adopted in 2016 that provides long-range implementing guidance in five-year increments, which calls for the “construction of maritime hubs” to safeguard China’s “maritime rights and interests” as it embarks on laying a “foundation for maritime Great Power status” by 2020 (GT, 2020). The centenary of the founding of the People’s Republic of China, 2049, has been set as the year when it will become the world’s “main maritime power” (海洋强国). Accordingly, China’s drive to acquire port access and secure supply lines are likely to intensify alongside the expansion of the Maritime and Polar Silk Roads.

The Maritime trade routes help China diversify its supply chains and create a China – Indian Ocean – Africa – Mediterranean Sea Blue Economic Passage to connect Africa to new maritime corridors in Pakistan, Bangladesh, Sri Lanka, and Myanmar. (See Details in Attachment 2).

But it worth noting, that China’s return on investment from increased port access and supply chains is not only about economics. In five cases (2 of which are in Africa) – Djibouti, Walvis Bay (Namibia), Gwadar (Pakistan), Hambantota (Sri Lanka), and Piraeus (Greece) – China’s port investments have been followed by regular People’s Liberation Army (PLA) Navy deployments and strengthened military agreements. In this way, financial investments have been turned into geostrategic returns. (See Details in Attachment 3).

Attachment 3: Global BRI strategy: roadmap

Within this scenario one can trace the implementation of well-known Chinese geopolitical strategy “string of pearls” and “blue waters”, which is primarily aimed at protecting China’s oil flows, establishing the country as a global Maritime power with diverse interests around the world, and overcoming US attempts to block access to China or its access to the world’s oceans (Smotrytska, 2020). Due to this strategies Africa (namely Djibouti and Walvis Bay) have a crucial role in this strategy in terms of security.

In this aspect we can see that the African vector of Chinese “diplomacy of straits” is playing a significant part in Chinese foreign policy. In 2016 it was stated that in Djibouti (the African side of the Bab el – Mandeb, connecting the Gulf of Aden (and hence the entire Indian Ocean basin and the Asia – Pacific region) to the Red Sea and further, through the Suez Canal, with the Mediterranean Sea), in the port city of Obock, work on the construction of a naval base of the PRC began. This base will not only enable Beijing to control the Bab – el Mandeb Strait to some extent, but also will serve as a military guarantee of Chinese interests on the African continent, which is (for 2014) USD 210 billions of trade turnover and USD 20 billions of FDI (Wang, 2007).

The base in Djibouti allowed the Chinese Navy to increase its presence in the Indian Ocean and became a stronghold in the event of an emergency evacuation of Chinese citizens from Africa (TRT, 2021).

In addition to purely security issues, Africa is also a market for Chinese weapons (Hruby, 2016). From 2013 to 2017, exports of Chinese weapons to Africa grew by 55% compared with the previous five years. From 2008 to 2017, China exported USD 3 billion worth of arms to Africa. Algeria already purchases 10% of all exports of Chinese weapons, including warships.

Thus, Africa’s importance to China in this regard stems from its location in the maritime zone, in which Beijing hopes to expand its presence and project its power. Indeed, ten years ago, China could not penetrate the adjacent waters of Africa. Today, it is estimated that the PLA Navy maintains five battleships and several submarines on continuous rotation in the Indian Ocean. This is set to increase in the coming decades as Chinese rival – India – ramps up its own presence in the area.

5. What is the significance of the Belt & Road Initiative in Europe?

When the policy of US Presidents D. Trump and later Joe Biden has brought uncertainty to relations between the world’s three largest economic partners – the US, China and the EU, collaboration between official Brussels and Beijing remained one of the most important factors in world politics. Thus, Sino – European relations are one of the primary factors determining the development of the entire system of international cooperation in Eurasia.

Modern relations between the European Union and China are characterized by a comprehensive content of the bilateral agenda, which includes issues of investment, trade, economic, political cooperation, environmental protection, etc. Same principals can be applied when analysing Sino – European collaboration within BRI (EP, 2020).

An important role in these relations is played by the countries of the Eastern borders of the EU – the countries of Central and Eastern Europe. As a kind of geopolitical bridge between Asia and Europe, the CEE countries providing the Chinese side with large platforms for investment and development of trade and economic collaboration. Despite the geo-economic prospects, however, the CEE countries also pose as a considerable threat to the promoting of the BRI project to the West (economically unstable, lack of reliable infrastructure and logistics, high level of political instability and conflicts) (Smotrytska, Sep.2020).

Also, providing a strong basics for development of China – EU ties, Sino – CEE relations, at the same time, bringing higher level of uncertainly and fears to European business and political circles. Thus, while implementing BRI in CEE region and hence strengthening economically and infrastructurally countries of the region, China contributes to shifting of “political preferences and support” of these countries from EU-oriented trends to East-oriented (which in some point can damage European identity and unity) (Smotrytska, 20.9.2020).

An important characteristic of Sino – EU relations (which the EU leadership is not fully supporting), is that instead of seeking a “block-based” approach with the whole of Europe, China develops multiple arrangements and memorandums of understanding, resulting in a certain East – West divide, with more Eastern European countries being BRI members (Lucas, 2021). This complicated puzzle of bilateral arrangements ultimately favours a hidden growth of Chinese continuous influence in Europe.

Nevertheless, it can be underlined, that the improving of Sino – CEE ties within BRI requires deep collaboration on the principle of mutual complementarity of economies of the region. Such complementarity provides an important basis for long-term business cooperation, because only in the process of joint efforts to create the BRI will it be possible to fully overcome the underdevelopment of infrastructure in the region. The cooperation between China, the EU and CEE countries can also contribute to the balanced development of Europe.

While talking about BRI from European perspective, the most relevant infrastructural projects of the Initiative are railways and ports. The BRI’s investments in railway and port infrastructure will certainly influence trade relations between China and Europe by lowering transportation costs and increasing trade volumes. New connections will develop trade and have an impact on each European country’s trade turnover with Asia. Thus, it is estimated that “a 10% reduction in railway, air, and maritime costs increases trade by 2%, 5.5% and 1.1% respectively” (Wade, Nov.2016). Nevertheless, the effects of new connections should also be analysed regarding the specific composition of trade flows.

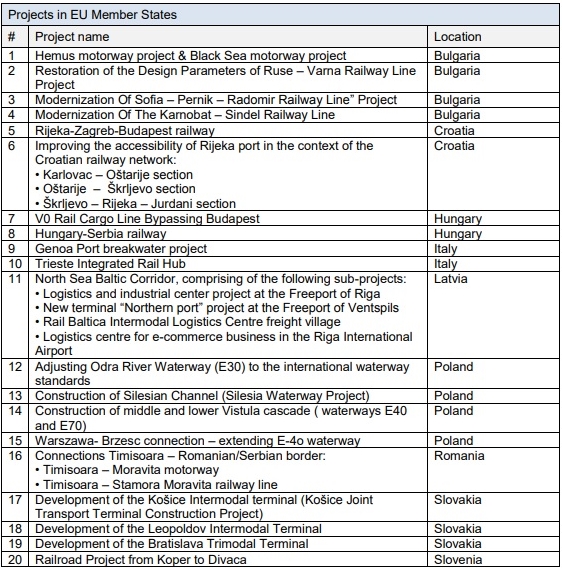

The maritime route of the BRI then is going to be the most relevant component of BRI both in terms of volume (93% of total trade in 2016) and value (61% of total trade in 2016) of goods in the Sino – European trade (Smotrytska, Feb.2021). This will reinforce the status of the Mediterranean and Southern Europe as the terminal point of the main BRI shipping route. (See Details in Attachment 4).

Also, the new shift in Sino – EU relations within BRI were intensified by the parallel impact of three concurrent factors:

- expansion of the Suez Canal in August 2015 that doubled the daily capacity of cargo transit;

- emerging “naval gigantism”, or the strategic use by the main shipping companies of huge vessels (between 13,000 and 22,000 TEU) that can only be hosted by the Suez Canal;

- acceleration of global alliances made by shipping companies to reinforce their economies of scale, as in the case of the Ocean Alliance, consisted of the China Ocean Shipping Company (COSCO), CMA CGM from France, Evergreen from Chinese Taiwan, and OOCL from Chinese Hong Kong, which controls 35% of the Europe – Far East route trade and 40% of the transpacific route trade (Prodi & Fardella, 2018).

These three concurrent phenomena (i.e., Suez enlargement, naval gigantism, and global alliances) are progressively reinforcing the competitive advantage of the Europe – Far East route, making it even more convenient than the transpacific route for the Chinese cargo directed towards the American north-eastern coast. These processes provide the European Mediterranean with an unprecedented “centrality” within both of China’s most important trade segments with Europe and the US.

Attachment 4: Projects presented under the EU – China Connectivity Platform. Projects in EU Member States

6. Why are there concerns about the expansion of Chinese trade routes? What threats BRI poses to other countries?

As any other project, global scope of the BRI reserves not only big number of opportunities, but also high level of uncertainly and challenges. Thus, the main groups of risks are as follows:

1. Environmental risks:

- BRI transport infrastructure is estimated to increase carbon dioxide emissions by 0.3 % worldwide – but by 7 % or more in some countries as production expands in sectors with higher emissions (Raiser & Ruta, 2019).

- creating bottlenecks in cold waters (Straits of Malacca and Singapore, Suez, Gibraltar, Panama, etc.;) (WowShack, 2017)

- interferes in Arctic and Antarctic circles (melting of ice, global warming);

- oil spills (mainly Indian ocean);

- biodiversity loss (mainly South-Asia waters) (Eldridge et al., 2014).

2. Social Risks:

- An influx of workers related to an infrastructure project could create risks of gender-based violence, sexually transmitted diseases, and social tensions.

- Increasing of development gap (between world regions and countries).

- Monopolization risks:

- There are examples of Chinese companies using the terms of a contract for financing the construction of infrastructure facilities to obtain, if possible, control over the recipient companies. For example, under the terms of the financing agreement, if the construction and commissioning of the facility is delayed, control of the foreign partner company passes to the Chinese company.

- countries’ technologies degradation (while implementing projects China prefer to use its manpower, raw materials, and technologies).

4. Governance Risks:

- Moving toward international good practices such as open and transparent public procurement would increase the likelihood that BRI projects are allocated to the firms best placed to implement them;

- absence of clear and stable policies transparency;

- interfere in territorial sovereignty of the countries (best example – countries of South-East Asia, Pakistan, Ukraine);

- inconsistency in legal and financial policies due to political instability in countries participants (best example – Myanmar, Russia, Ukraine, Pakistan, Kashmir).

5. Business risks:

- BRI countries have more restrictive and burdensome FDI policies than high-income OECD countries, in terms of starting a foreign business, accessing industrial land, and arbitrating commercial disputes (Ruta, 2018);

- Risk of losing control over project (if country can’t cover the dept – construction company (China) can take over the facility/project/profits);

- corruption risks.

6. Debt Sustainability Risks:

- Among the 43 corridor economies for which detailed data is available, 12 – most of which already face elevated debt levels – could suffer a further medium-term deterioration in their outlook for debt sustainability;

- FDI to projects exceeds country’s GDP (Best examples: B&H, Cambodia, Laos, Greece, Djibouti)

And the last group of risks can be identified in its geo-economic and geopolitical scope (should be noted that this group is a basic of majority of fears about the expansion of the BRI (especially from the EU, the US, and Indian perspectives)):

7. Geopolitical and geo-economic risks:

7.1. Geostrategic aspect:

– the project is consistent with the logic of the classical geopolitical Formula: “…who rules Eurasia controls the destinies of the world”;

– creating “fulcrums” within strategical transportation hubs (CEE, ASEAN region, Gwadar, Djibouti etc.) through over the world;

– takes control over Indian Ocean: the realization of the idea of building the Kra – Canal (The Thai Canal through the Malacca Peninsula of Thailand), connecting the Pacific (Siamsky Bay) and the Indian (Andaman Sea) oceans.

– according to the long-standing tradition of the “Chinese box” (foreign policy strategies “string of pearls”, “blue water”, etc.), the main geopolitical goal of the Chinese project is gradually revealed to the outside world:

- 2013 – 2017: gradual opening of foreign policy and economic objectives;

- 2017 – …: entering the path of reaching the main goal (creating a large Eurasian multidimensional space with a huge consumer market)

7.2. Resource’s aspect:

– within Maritime Silk Road (MSR) the construction of oil and gas pipelines from the coast of the Arabian Sea to China’s Xinjiang provides stable oil imports bypassing the Strait of Malacca (hence not controlled by the US and India);

– within Polar SR get access to resources-rich Arctic region (gas and oil);

– within land BRI get access to resources of Eurasia and receive massive discounts on the import of gas (from Central Asia mainly);

– within Polar SR along the Northern Sea Route in the Arctic, facilitate increased resource extraction and cargo deliveries, as well as tourism and scientific opportunities;

– As a result, second quarter of 2021: Total FDI Energy – 44 %, transport – 30% (considering Pandemic impact) (UNSTAD, 2021).

7.3. Military aspect:

– Within MSR places military bases and electronic intelligence facilities in friendly Southeast Asian countries (Myanmar, Cambodia, Thailand, Bangladesh) ;

– the deployment of a naval base and electronic intelligence station in Gwadar (on the Makranska coast of Baluchistan (Pakistan)) will ensure the security of oil imports from Iran and control the transportation of oil from the Persian Gulf zone to India;

– Development diplomacy of Straights (strategies “string of pearls”, “blue water”, etc.);

– the construction of a naval base in Djibouti allows to take under control imports of oil (the Bab – el Mandeb and Hormuz Straits) and gives military guarantees of Chinese interests on the African continent;

– control over South China Sea and partially Indian Ocean (to control oil/gas import) (Smotrytska, 2021).

7.4. Geo-economic aspect:

– A multidimensional model of regional cooperation will expand the geo-economic space for development by forming the following areas (corridors):

1. Transport Corridor,

2. Energy Corridor,

3. shopping corridor,

4. Cyber and Information corridor,

5. Scientific and technical cooperation,

6. Agricultural development,

7. Cultural exchange

8. Increase educational and career opportunities,

9. Tourism Development,

10. security and political interaction.

– BRI, MSR and Polar SR along with the creation of Port outposts in ASEAN, Africa and CEE indicates intentions to take soft “economic” control over the whole of Eurasia and Africa.

8. Which BRICS members will take more advantage of the new BRI structures?

An obvious winner (from BRICS) of new structure is China. Thus, few aspects can be underlined during the analysis of an impact of BRI on separate nation:

- A large global economy such as China will almost inevitably gain market power through its economic size and its importance as a trading partner;

- Increasing the speed of the extension of use of Chinese goods, technologies and investments abroad (export not only of goods, but factories), gaining power through FDI and “shares” approach;

- In the last quarter of 2020, China’s trade with Belt and Road countries increased by 3.2%, almost 10% points higher than the overall negative growth rate of China’s foreign trade volume (Kuhn, 2020);

- BRI is expected to boost China’s GDP by 0.3% every year over a 10-year period, and provide access to new resource-rich markets and trade routes, and reduce its reliance on existing ones (UN, 2020);

- Chinese companies are entering the banking, technology, and retail sectors in BRI markets through 3 continents. Globalizing their economy and extending borders of country’s geoeconomics influence.

And that’s only talking in economical aspect, without mentioning the infrastructure, geopolitical impact, and geo-economic and cultural expansion.

Even though it is worth noting numerous benefits for Russia, South Africa (especially considering countries’ poor economic development, unsatisfactory logistics and Russian – Ukrainian crisis), outcomes for Brazil (which is rather distant player) and India (which rather loses than gains from the BRI), China remains the main “BRICS beneficial” of the BRI.

9. Which countries will benefit the most from the BRI?

As BRI became a “process – brand”, the number of countries which could benefit from the Initiative grew gradually:

- Western Europe (Brattberg & Soula, 2018) and Latin America (Boo & de Los Heros ,2020) are expected to gain significantly in terms of economic development. Local companies, especially those involved in trade, logistics and construction, stand to benefit as the region begins to recognize the benefits of being a BRI hub;

- Central – East Europe: Development of energetic, logistics fields allow the region to strengthen its’ position within the EU as an important logistics hub of Europe, at the same time bringing energy Independence for majority of the countries of the region (Smotrytska, 20.9.2020);

- in Africa, as of late 2020, over 90 BRI-linked projects were estimated to be in the pipeline; the USD3.2 billion railway line linking Kenya’s capital Nairobi with its port city of Mombasa on the Indian Ocean is one example of the impact BRI is having on the continent (Smotrytska, 2021);

- China’s trade with the Middle East has grown over 10-fold between 2000 and 2016 to USD114 billion. And the BRI is expected to further strengthen this relationship, helping raise Dubai’s status as a key access point into the region for Chinese businesses (Sidło, 2020);

- In the Central Asia, China is investing USD4.5 billion worth of road, power, and gas pipeline projects in Kyrgyzstan alone. One of the routes through region is a 12,000km-long freight train line that connects China with the UK via Kazakhstan and Belarus, with the potential to cut cargo transit times by half, the China – Europe Railway Express service is already linking dozens of cities across Europe and Asia (Taliga, 2021);

- Major projects in the South Asia include upgrading Bangladesh’s transport links and building ports and power plants in Sri Lanka and Pakistan. Other sizable investments include projects in Mongolia that are worth nearly as much as the country’s 2017 nominal GDP (USD3 billion) and USD5.2 billion to build three airports across Cambodia (Yuan, 2019);

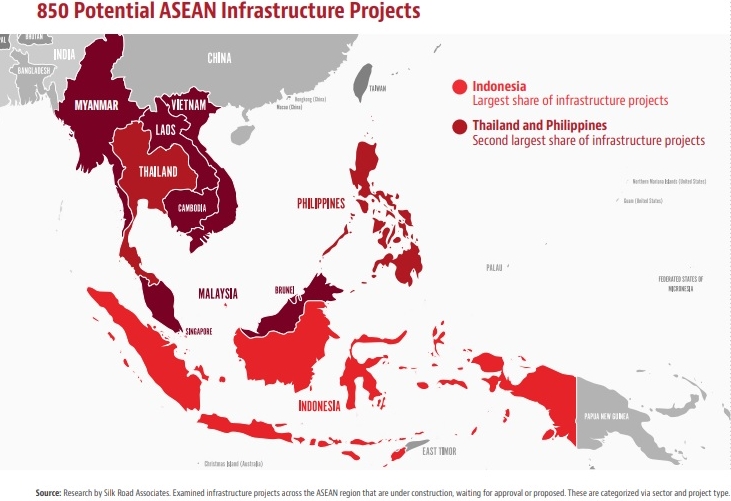

- In ASEAN region, China’s FDI nearly doubling between 2014 and 2017. South Asia and Southeast Asia have received the lion’s share of Chinese outbound FDI to B&R countries. Countries such as Laos and Philippines are expected to benefit significantly – for example, from Chinese funding and technical know-how for the construction of rail links (Tritto & Sejko, 2021).

Thus, much of the increase in outbound greenfield FDI to BRI countries is concentrated in South Asia, Africa, and Central Asia, while the increase in construction projects is concentrated in South Asia, the Middle East, and Southeast Asia. Even though, so far, the main beneficiary remains ASEAN region, as it is expected to require USD26 trillion in infrastructure investment between 2016 and 2030, or USD1.7 trillion a year, to maintain its growth momentum and BRI helps fund a sizable portion of that.

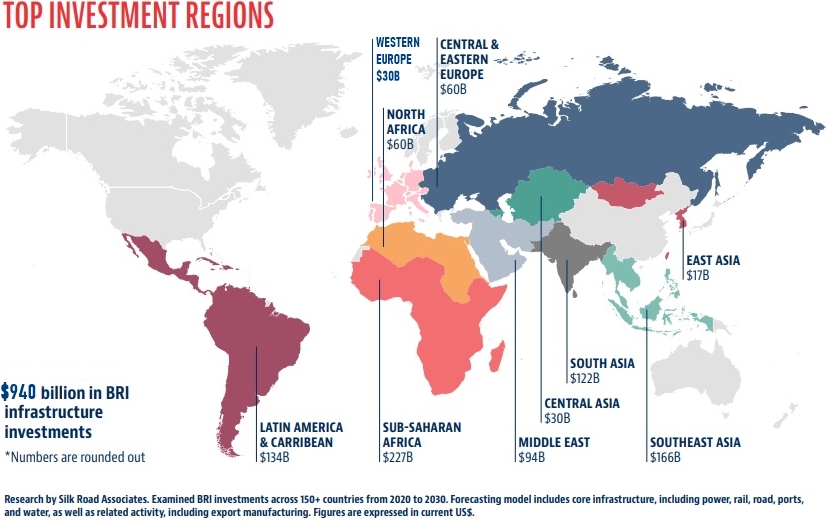

(See Details in Attachment 5 and Attachment 6)

Attachment 5: BRI’s impact on worlds regions

Estimated BRI investments across 150+ countries from 2020 to 2030. Forecasting model includes core infrastructure, including power, rail, road, ports and water, as well as related activity, including export manufacturing.

Attachment 6: Main beneficials of BRI

10. How has the Covid-19 pandemic affected the progress of the Belt & Road Initiative?

When the whole world can see how a pandemic can change and affect people’s lives, one needs to understand that in politics, its consequences vary slightly from country to country.

In China they managed to take an outbreak under strictest control relatively fast, but it obviously influenced (and influences) Chinese economy and foreign policy significantly (especially in “lowest” level, considering that country strictly closed its borders to all the foreigners and limited to minimum inter-countries connections).

Moreover, due to the Pandemic restrictions China had to adapt the new BRI strategy in a way, the initiative can still fulfil its mission. Thus, the country implemented a new post-Covid-19 domestic strategy, which further was expanded on big implications for China’s trade with BRI countries. The new strategy was called “dual circulation” (strategy, which envisions a new balance away from global integration (the first circulation) and toward increased domestic reliance (the second circulation)) and implies several simultaneous shifts (Blanchette & Polk, 2020):

• Strengthening Chinese domestic consumer markets as a source of economic growth;

• Prioritizing domestic high-tech manufacturing and associated services for export;

• Reducing dependency on income from exporting low-value manufactured goods; and

• Reducing dependency on singular sources of imports into China.

This shift could benefit BRI countries, at least in the short and medium term. For instance, currently providing just 4% of China’s imports, African countries may gain from the import diversification and consumer market growth the policy implies.

Thus, the biggest impact pandemic had on the BRI – is an access to Chinese marked and access to China itself. From March 2020 it is extremely difficult to get even the most astute and innovative foreigner businesspeople and their new products into China, especially value-added products (Xiaolong, 2020). Entrance into China will require considerable relaxation of China’s immigration rules and non-tariff trade restrictions with BRI countries, both of which have yet to be seen in (hopefully) 2021.

But the impact was not only limited to an “access” restriction. Thus, in June 2020 China revealed that 20% of BRI projects had been “seriously affected” by the virus, with up to 40% being “somewhat affected” (Zou, 2020). That meant that the overall BRI investment dropped by a whopping 50% in the first half of 2020, down from USD46bn in the same period in 2019 (Shehadi, 2020). Due to this numbers (and since China’s internal economy is under great pressure because of Covid-19), Chinese leadership decided it is smarter for the time-being to concentrate more on inner development, rather than massively investing money overseas, so further investment is likely to be thought out much more carefully with a particular focus on profit, something that many BRI investments currently lack. (See Details in Attachment 7).

Attachment 7: Number of construction projects owned by Chinese corporations, 2010-2020

But this data does not mean that China could not keep BRI lending in high gear, however. BRI loans are just a small part of China’s overall lending portfolio, and China’s main policy banks have enough political backing to bear the cost of upcoming (and those “frozen” due to the pandemic) projects.

Additionally, in addition to the supply shock, Covid-19 has reduced the demand of many countries for BRI investments, not least due to falling energy needs and a decrease in the ability to borrow money.

Worth noting the current usage of BRI transhipment roads to supply other countries with medical technology and medicine to help fighting the Covid-19 outbreak outside of China. Starting from January 2020 government took “medicine field” (especially technologies that use AI and other innovations that monitor Covid-19 carriers) under the strictest control, giving “export rights” only to those enterprises which are checked (quality standards) and authorized (Shehadi, 2020). Meanwhile, international e-commerce initiatives in the field of MedTech are also being prioritized to help accelerate economic growth in China.

Investments on energy-related projects outside and inside China were influenced by Pandemic the most (Tu, 2020). Thus, the drop has hit traditional fuels the hardest. In fact, the first half of 2020 was the first six-month period in which non-fossil fuel-related energy investment (including large hydropower and solar power) dominated BRI energy investments, which further helped to implement the “Greening of BRI” strategies (Cell Press, 2019). The turn into “greening” became very resultative in long-tern run point of view (i.e., the EU always underlined that “the BRI is not green enough” to be safely and successfully implemented within Europe). But these trends will become clearer once the dust settles and a global Covid-19 vaccination programme begins.

As for current way to further maintain and develop the BRI, China seeks to share its valuable experience of battling Covid-19 with other BRI countries, one key area of potential will be in projects focused on strengthening the health systems of low-income countries, even if focused on soft processes rather than hard infrastructure.

Also, beyond the short-term, changes to global supply chains will bring new opportunities for diversification through joint activity with other countries. There is also potential for accelerated digital BRI (Digital Belt and Road) activity in relation to Chinese tech companies and private players may now become more active in the BRI (Lewis et al., 2021).

11. What are the long-term prospects for BRI? Can the Chinese Belt & Road be considered the beginning of the Asian century?

Exploring the nature of the new geopolitical project, it should first be emphasized that it is aimed at radically changing the entire economic map of the world. In addition, many economic experts consider this project as the first shot in the struggle between East and West for influence in Eurasia.

Belt&Road Initiative, based on a multidimensional approach (“five connections”) is promoting mutually beneficial international cooperation. Thus, in contrast to the United States, which relied on the path to world hegemony for neoliberal globalization, China’s foreign policy has taken a course to regionalize international economic relations.

Economically, China will remain the engine of growth for Asia and the world. Its contribution to global growth will rise to over 28% by 2023 (a compound annual rate of 6.1 per cent), according to IMF projections (Huiyao, 2019). However, the nature of China’s economic role will evolve along with domestic rebalancing.

The initiative is also projected to boost global trade by 12% impacting more than 65 countries and nearly two-thirds of the world’s population (Konings, 2018).

Short long-run Sum up:

- BRI is estimated to provide (Globe):

- to raise global GDP by about 4.2 % in 2040, or 9.3% of GDP in 2019 – 2021 (Cebr, 2019);

- up to 56 countries forecast to have their annual GDP in 2040 boosted by more than USD10 billion as a result (Cebr, May 2019);

- establish over 35 economic corridors to include the following strategic distribution lanes, which will impact the future transport of commercial goods (OECD, 2018).

- A targeted completion date (100th anniversary of the PRC (2049)):

- China would make several trillion USD dollars’ (4 – 8) worth of investments – in ports, airports, roads, railways (including high-speed routes), bridges and tunnels, as well as power plants and telecommunications networks (OECD, 2018);

- One of the more notable examples included a clean energy “super grid”, consisting of ultra-high voltage electricity networks linking China and much of the Eurasian continent (Zhang, 2018).

- BRI is estimated to provide (China):

- a competitive advantage in the processing of vessels in the world’s major canals, processing of goods at the major ports of entry;

- the prioritization of the ground transport of goods in key countries’ economic zones;

- ability to leverage port economics within BRI participating ports provides it with a commercial advantage in the global market;

- as China’s industrialization and GDP grow, its exports will start levelling with US exports in the commercial market.

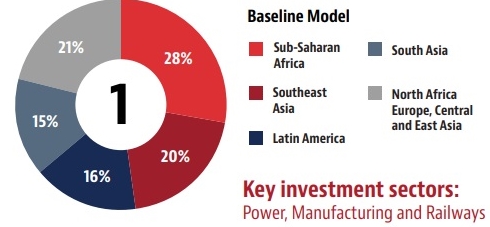

Thus, we can forecast 5 main scenarios (models) of the further development of the BRI:

1. Baseline Model: Continuing the current trajectory equals an estimated USD 940 billion in BRI infrastructure investments

If BRI infrastructure investments stay on their current course, the original 65 core BRI countries will continue to see significant investment, as will the recently joined Latin American countries. In this model, while the number of BRI projects will continue to increase, many projects will be of average size and smaller value, which is a trend already in evidence. (See Details in Attachment 8).

Attachment 8: Baseline Model

2. Global Cooperation Model: Collaboration wins big, totalling USD 1.32 trillion in BRI investments

Lessons learned so far, point to collaboration as the win-win BRI solution that reduces political opposition and ensures the highest long-term success rate for infrastructure projects and better access to ongoing multilateral funding. This scenario is based around more formal partnerships between China and external 3rd parties, including other governments and private capital, and BRI-project alignment with the multilateral development banks. (See Details in Attachment 9).

Attachment 9: Global Cooperation Model

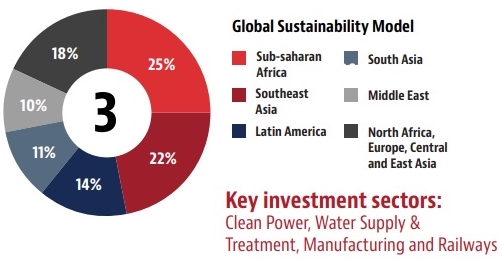

3. Global Sustainability Model: Sustainability becomes a key driver, pushing future BRI investments to USD 1.2 trillion

If China adopts a policy of even closer alignment between its BRI goals and sustainable initiatives, it is very likely that it will gain access to new streams of multilateral funding for BRI projects. It will also make Chinese engineering and construction companies more competitive globally to win major clean energy and water project bids as part of BRI. (See Details in Attachment 10).

Attachment 10: Global Sustainability Model

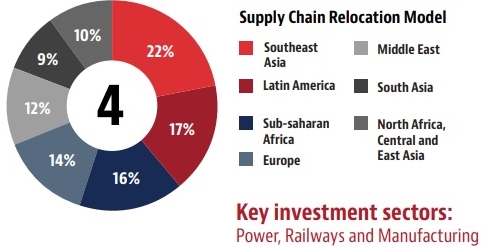

4. Supply Chain Relocation Model: With tariffs remaining high over a longer-term period, BRI infrastructure projects can still garner an estimated USD 1.06 trillion

Ongoing trade tensions between the US and China have led to the partial relocation of manufacturing away from China, including by Chinese companies, to low‐cost countries in Southeast Asia and South Asia. In this scenario the influx of manufacturing sees renewed interest in BRI infrastructure investments in these countries (private and through state-owned enterprises) to support the production relocation. (See Details in Attachment 11).

Attachment 11: Supply Chain Relocation Model

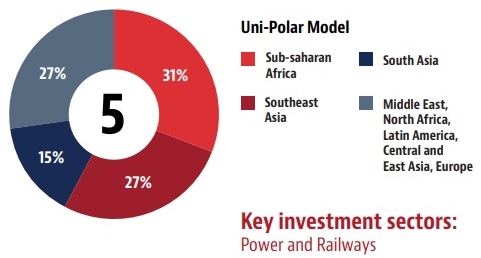

5. Uni-Polar Model: Global protectionism dampens down future BRI investment, totalling USD 560 billion.

Fierce, politicized and protectionist competition among countries will almost halve global BRI investments when compared with the Baseline Model (Forecast 1). Of all the five forecasts, this one offers the most modest benefits to all stakeholders. (See Details in Attachment 12).

Attachment 12: Uni-Polar Model

If we are talking about possible Asian Century, lying at the heart of the regional economy, China will undoubtedly play a central role in Eurasia. Implementing BRI and hence recognizing that multilateralism is the only way to meet our transnational challenges and sustain an open, inclusive global economy, China’s role in Asia and the world will be to uphold the international order while offering innovative solutions to global governance, in line with its responsibility as a major global player.

In the previous phase of globalization, Chinese exports drove global trade as foreign investment came in to help modernize the economy. In globalization 4.0, Chinese imports will play an ever-larger role as Chinese multinationals invest across Asia and the world. From now until 2030, Asia’s consumption growth is expected to exceed that of the US and Western Europe combined (Huiyao, 2019).

It is estimated that if fully implemented, BRI transport projects could increase trade between 1.7% and 6.2% for the world, increasing global real income by 0.7% to 2.9% and helping to lift 7.6 million people from extreme poverty in the process (Pazarbasioglu, 2019). To truly fulfil BRI’s potential, over the coming years, the BRI will shift towards a more multilateral approach.

But to discuss whether BRI’s implementation is the beginning of the Asian Century is not quite right. Moreover, it is still too early to talk about the existence of such at all (ADB, 2019).

Chinese economy and potential are strong, BRI’s and Asia’s are even bigger, but one needs to understand, that being a locomotive of the new era is not only about having strong economy and development, but about having the high level of stability and security. While some countries in Asia (i.e., China, Japan, South Korea) boast stability, the level of security and stability in the region as a whole is still low compared to the old world (Europe).

Moreover, BRI can be also considered as a new approach of Chinese foreign and domestic policies to adapt to the new trends in worlds geopolitics and disproportionate development of the country itself. In 21st Century, when Chinese Political Economy is observed, it is to be seen that engines of the economy that once led China to development become the very problems that are distorting the development and growth today. Those problems make the “challenges of China”, and they are deeply connected to each other making local operations ineffective in long term solutions. Hence, China needs a restructuring in social and economic architecture of the country that will not only enable a grand solution to those challenges but that will also guarantee the stability in domestic affairs. By employing BRI, China aims to achieve peace and harmony in its’ domestic structures regarding economy and society. Therefore, China’s domestic challenges render BRI essential for the survival of a stable China.

Referring to the global scale and importance of the BRI for current China’s existence, it should be noted that the BRI represents a possible integration mechanism in Eurasia, led by China, which unites Asia within its borders, but also has a dangerous asymmetric structure (the size of China’s huge economy and the smaller economies in most of the receiving countries along the BRI). It brings us to the issue of the creation of stable multilateral setting which can tackle not only economic, but security issues in Asia.

History shows that, unlike Europe, Asia was never forced to create a culture of negotiation: while the whole of Europe was twice involved in devastating wars in which it could not win, countries were forced to sit down at the table of diplomacy and negotiation, which ultimately led to the creation of a compromise – Organization for Security and Co-operation in Europe. The countries of Asia, on the contrary, have never been on the brink of survival in recent history, which, as a result, has not forced the countries to create a pan-continental union or a single pan-Asian integration mechanism.

Up to day countries of the region did not create a stable multilateral mechanism which can help them to work out a compromise solution on the issue of legal registration of state borders and territorial claims (Bajrektarevic, 2014). Even despite the fact, that Asian countries today are more willing to consult and cooperate with each other on the integration and creating of the zone of co-prosperity issues, nevertheless in Asia, there is hardly a single state which has no territorial dispute within its neighbourhood. This issue is one of the most important, since it can guarantee the territorial integrity of States and ensure non-interference in their internal affairs, as well as represent one of the barriers to external threats to their national security, such as smuggling, international crime, extremist and terrorist movements, illegal migration.

Numerous integration mechanisms such as ASEAN, APEC, SAARC or BRI in most cases, are created to jointly solve economic problems, achieve economic integration in the region or sub-regions, but not to tackle security issues.

Economically and potentially strong East today lacks stable political integration and is unable to capitalize (on) its success. To consolidate the total power of Asian countries the largest continent must consider the creation of its own comprehensive pan-Asian multilateral setting, without which it is impossible to establish an Asian century.

References:

- ADB (2019), Asia 2050: Realizing the Asian Century, Asian Development Bank, URL: hyperlink (Access 20/7/2021)

- Bajrektarevic A.H. (2014), No Asian Century, Modern Diplomacy media platform, URL: hyperlink (Access 5/6/2021)

- BBC (2013), What does Xi Jinping’s China Dream mean?, BBC, URL: hyperlink (Access 12/7/2021)

- Blanchette J., Polk A. (2020), Dual Circulation and China’s New Hedged Integration Strategy, Center for Strategic and International Studies, URL: hyperlink (Access 16/7/2021)

- Brattberg E., Soula E. (2018), Europe’s Emerging Approach to China’s Belt and Road Initiative, Carnegie Research, URL: hyperlink(Access 17/7/2021)

- BRI (2020), Belt and Road Initiative, BRI Newslette, URL: hyperlink (Access 15/7/2021)

- Boo B.,C., de Los Heros J.C. (2020), China’s BRI& Latin America: A New Wave of Investments? GRI News Reports, URL: hyperlink(Access 17/7/2021)

- Cebr (2019), From Silk Road To Silicon Road : World Economic League Table 2019, The Chartered Institute of Building Report, URL: hyperlink (Access 23/7/2021)

- Cebr (May 2019), Belt and Road Initiative to boost world GDP by over $7 trillion per annum by 2040, The Chartered Institute of Building Report, URL: hyperlink (Access 23/7/2021)

- Cell Press (2019), Solar energy could turn the Belt and Road Initiative green, URL: hyperlink (Access 20/7/2021)

- DevelopmentReimagine (2019), Countries Along The Belt And Road- What Does It All Mean? URL: hyperlink (Access 19/7/2021)

- Eldridge, M. D. B; Meek, P. D; Johnson, R. N. (2014), Taxonomic uncertainty and the loss of biodiversity on Christmas Island, Indian Ocean, URL: hyperlink (Access 11/7/2021)

- EP (2020), EU–China Comprehensive Agreement on Investment. Levelling the playing field with China, European Parliamentary Research Service, URL: hyperlink (Access 24/7/2021)

- GT (2020), Summary of the 13th Five-Year Plan 2016-20, The Global Times, URL: hyperlink (Access 12/7/2021)

- Hopkins N. (2012), Militarisation of cyberspace: how the global power struggle moved online, The Guardian, URL: hyperlink (Access 19/7/2021)

- Hruby A. (2016), China’s Investments in Africa: What’s the Real Story?, URL: hyperlink (Access 22/7/2021)

- Huiyao W. (2019), In 2020, Asian economies will become larger than the rest of the world combined – here’s how, World Economic Forum Report, URL: hyperlink (Access 20/7/2021)

- Jiang Y. (2021), The Continuing Mystery of the Belt and Road, The Diplomat magazine, URL: hyperlink (Access 21/7/2021)

- Jie J. (2017), China to contribute additional 100 billion RMB to Silk Road Fund: Xi, Xinhua, URL: hyperlink (Access 18/7/2021)

- Koda Y. (2017), China’s Blue Water Navy Strategy and its Implications, Center for a New American Security Report, URL: hyperlink(Access 13/6/2021)

- Konings J. (2018), Trade impacts of the Belt and Road Initiative, URL: hyperlink (Access 20/7/2021)

- Korolyov V.,V. (2019), Project OBOR (One Belt One Road) as a historic challenge for Central Asia. Look from Kazakhstan, Kazakh-German University Journal, URL: hyperlink (Access 17/7/2021)

- Kuhn L.,R.(2020), How China’s BRI contributes to global economic recovery, CTGN, URL: hyperlink (Access 12/7/2021)

- Lee A. (2020), Belt and Road Initiative debt: how big is it and what’s next? South China Morning Post, URL: hyperlink (Access 15/7/2021)

- Lewis D.,J. Xiaohua Yang, Diana Moise and Stephen John Roddy (2021), Dynamic synergies between China’s Belt and Road Initiative and the UN’s Sustainable Development Goals, Journal of International Business Policy, URL: hyperlink (Access 21/7/2021)

- Liangyu (2017), President Xi says to build Belt and Road into road for peace, prosperity, Xinhua, URL: hyperlink (Access 17/7/2021)

- Lucas E. (2021), China’s bid to divide the EU, URL: hyperlink (Access 28/7/2021)

- Moran T. (2010), Is China trying to “lock up” natural resources around the world? CEPR’s policy portal Research, URL: hyperlink (Access 21/7/2021)

- Mudbhary K. (2006), Rapid growth of selected Asian economies. Lessons and implications for agriculture and food security: Synthesis report, FAO Regional Office for Asia and the Pacific, Bangkok, Thailand, p. 75-79.

- Nedopil, Wang, Ch. (2021), China Belt and Road Initiative (BRI) Investment Report 2020, Green Belt and Road Initiative Center, URL: hyperlink (Access 21/7/2021)

- OECD (2010), China in the 2010s: Rebalancing Growth and Strengthening Social Safety Nets, OECD contribution to the China Development Forum Reports, URL: hyperlink (Access 15/7/2021)

- OECD (2018), “The Belt and Road Initiative in the global trade, investment and finance landscape”, OECD Business and Finance Outlook 2018, OECD Publishing, Paris, URL: hyperlink (Access 22/7/2021)

- Page J. (2014), China to Contribute $40 Billion to Silk Road Fund, The Wall Street Journal, URL: hyperlink (Access 12/7/2021)

- Pazarbasioglu C. (2019), Belt and Road Economics: Opportunities and Risks of Transport Corridors, The World Bank Group, URL: hyperlink (Access 20/7/2021)

- People’s Daily (2017), Xi’s ‘common destiny’ for mankind enlightens world: People’s Daily, The Global Times, URL: hyperlink (Access 19/7/2021)

- Prodi G., Fardella E. (2018), The Belt And Road Initiative And Its Impact On Europe, Russia in Global Affairs Journal, URL: hyperlink(Access 14/7/2021)

- Raiser M., Ruta M. (2019), Managing the risks of the Belt and Road, URL: hyperlink (Access 1/7/2021)

- Ruta M. (2018), Three opportunities and three risks of the Belt and Road Initiative, URL: hyperlink (Access 18/7/2021)

- Sidło K. (2020), The Chinese Belt and Road Project in the Middle East and North Africa, Center for Social and Economics Research, URL: hyperlink (Access 10/7/2021)

- Sejko D. (2019), Protecting Foreign Direct Investment in the Belt and Road Countries, HKUST IEMS Reports, URL: hyperlink (Access 17/7/2021)

- Sharma Sh.,D.(2002), Why China Survived the Asian Financial Crisis? Brazilian Journal of Political Economy, URL: hyperlink (Access 15/7/2021)

- Shehadi S. (2020), How Covid has changed China’s Belt and Road Initiative, Investment Monitor Report, URL: hyperlink (Access 18/7/2021)

- Smotrytska M. (2020), “Silk” geopolitics as a new phenomena of XXI century, Modern Diplomacy media platform, URL: hyperlink(Access 20/6/2021)

- Smotrytska M. (Sep.2020), Belt and Road in the EU, Central and East Europe: Roads of challenges, Modern Diplomacy media platform, URL: hyperlink (Access 20/6/2021)

- Smotrytska M. (20.9.2020), Belt and Road in the Central and Eastern EU and non-EU Europe: Obstacles, Sentiments, Challenges, International Institute IFIMES, URL: hyperlink (Access 20/6/2021)

- Smotrytska M. (2021), World Ocean Safety and Logistics: Chinese “Diplomacy of Straits”, Modern Diplomacy media platform,URL: hyperlink (Access 25/7/2021)

- Smotrytska M. (Feb.2021), IFIMES for the Global Greening Economy (A Brief Impact Study) , International Institute IFIMES, URL: hyperlink (Access 24/7/2021)

- Smotrytska M. (Jul.2021), The Arctic Silk Road: Belt And Road In North Dimension. Fight For The North, Modern Diplomacy media platform, URL: hyperlink (Access 25/7/2021)

- SRS (2019), China’s Economic Rise: History, Trends, Challenges, and Implications for the United States, URL: hyperlink (Access 25/7/2021)

- Taliga H. (2021), Belt and Road Initiative in Central Asia. Desk study, Friedrich-Ebert-Stiftung Reports, URL: hyperlink (Access 23/7/2021)

- Teixeira A.,G. (2019), Why China leads the world in logistics, CGTN, URL: hyperlink (Access 17/7/2021)

- Tritto P., Sejko (2021), The Belt and Road Initiative in ASEAN – Overview, HKUST IEMS Reports, URL: hyperlink (Access 18/7/2021)

- TRT (2021), Why is the US concerned about China’s naval base in Djibouti? Paper, URL: hyperlink (Access 22/7/2021)

- Tu K.,J. (2020), Covid-19 Pandemic’s Impacts On China’s Energy Sector: A Preliminary Analysis, Center on Global Energy Policy, URL: hyperlink (Access 22/7/2021)

- UN (2020), World Economic Situation and Prospects 2020, URL: hyperlink (Access 16/7/2021)

- UNSTAD (2021), World 2021 Investment Report, United Nations Conference On Trade And Development Reports , URL: hyperlink(Access 28/7/2021)

- US Dep.of State (2011), Remarks on India and the United States: A Vision for the 21st Century, URL: hyperlink (Access 11/7/2021)

- US Dep.of State (2020), United States Strategy for Central Asia 2019-2025: Advancing Sovereignty and Economic Prosperity (Overview), Bureau of South And Central Asian Affairs Report, p. 91-104.

- Wade Sh. (2016), Afghanistan: China’s ‘New Silk Road’ Picks Up Where Hillary Clinton’s Flopped, The Forbes Journal, URL: hyperlink(Access 11/7/2021)

- Wade Sh. (Nov.2016), The Countries Building The New Silk Road — And What They’re Winning In The Process The Forbes Journal, URL: hyperlink (Access 21/7/2021)

- Wade Sh. (2019), What China Is Really Up To In Africa, The Forbes Journal, URL: hyperlink (Access 21/7/2021)

- Wang J.,Y. (2007), What Drives China’s Growing Role in Africa? IMF Working Paper, URL: hyperlink (Access 2/7/2021)

- Wayne M. Morrison (2009), China and the Global Financial Crisis: Implications for the United States, Congressional Research, URL: hyperlink (Access 15/7/2021)

- WITS (2017), China trade balance, exports and imports by country 2017, URL: hyperlink (Access 12/7/2021)

- WowShack (2017), 14th Choke Point – How Vital Are The Malacca Straits To Global Trade? URL: hyperlink (Access 11/7/2021)

- Xiaolong W. (2020), China says one-fifth of Belt and Road projects ‘seriously affected’ by pandemic, Reuters, URL: hyperlink (Access 2/7/2021)

- Yuan J. (2019), China’s Belt and Road Initiative in South Asia and the Indian Response, Issues & Studies Journal, URL: hyperlink (Access 21/7/2021)

- Zhang C. (2018), An Asia Super Grid Would Be a Boon for Clean Energy—If It Gets Built, Council on Foreigner Relations, URL: hyperlink(Access 26/7/2021)

- Zou R. (2020), Assessing the Impact of Covid-19 on the Belt and Road Initiative, China&US Focus, URL: hyperlink (Access 8/7/2021)

About the author:

Dr Maria Smotrytska is research fellow at IFIMES/DeSSA, a senior research sinologist, specialized in the investment policy of China; BRI-related initiatives; Sino – European ties, etc. She is distinguished member of the Ukrainian Association of Sinologists. She has PhD in International politics, Central China Normal University (Wuhan, Hubei province, PR China).

Ljubljana/Shanghai, 3 August 202

Source: here